Search ETFtracker

Please note that this search feature is new and may refer to pages on ETFtracker that have been consolidated or removed. This only effects the Pages results not the blog or forum.

101 items found for ""

- Getting Started with ETFS - Part 6

Our Favourite ETF podcasts and shows In this part we look at where to continue watching, listening and learning about ETFs. We list our favourite podcasts and some links where to find them. We will continue to add to this list over time but if you have any favourites that you'd like to see, add a comment below and we'll consider adding them. Hope this is helpful on your ETF education journey! Note: I know it's Spotify heavy on the links but we'll add the Apple equivalents later on. Before we get started, this is the 6th part of the wider Getting Started with ETFs series. Just like we dive into the data, you can either dive back to one of the previous epsidoes or look ahead to future episodes when they are available. Part 1 - What to read, watch or listen to to get started Part 2 - What kind of ETFs are there? Part 3 - What data we look at when analysing ETFs Part 4 - Examples of ETF analysis Part 5 - Where to trade ETFs Part 6 - Our favourite podcasts and shows Podcasts ETF Edge - from the folks at CNBC. this is hosted by Bob Pisani (Stocks Editor at CNBC) and he is joined by market participants to chat all range of topics in the world of ETFs. Mostly an American perspective but still useful here in Australia. ETF Edge: Spotify / YouTube ETF Prime - from Nate Geraci and team at the ETF Store, an investment advisory offering perspectives on ETFs. Nate's weekly podcast is also great to learn more about the industry. Less videos on YouTube here but the podcast content is updated on the regular. ETF Prime: Spotify / YouTube Let's Talk ETFs - this one is from the team at Seeking Alpha (the home of crowdsourced equity and other market research) and in this series, Jonathan Liss and team talk to various fund managers, ETF issuers, asset managers and more to see how the ETF industry evolves. Let's Talk ETFS: Spotify The Alpha Females Invest - a new and local one from 2 females working in the investments industry and they talk with a diverse range of guests from brokers, to ETF issuers to those working in crypto. Their topics include breaking down the role of institutional broking and the role of carbon in the equity market. Definitely one to keep an eye on as they add more episodes. The Alpha Females Invest: Spotify Equity Mates - Well known and well loved podcast series from Bryce Leske and Alec Renehan, founders of Equity Mates Media. They've had a couple of great getting started series on ETF investing (see our Getting Started Guide - Part 1 for more). Check out their episodes on their podcast as well as their collaboration with ausbiz. Equity Mates: YouTube / Spotify / ausbiz Shares for Beginners - In this series, host Phil Muscatello interviews various experts on topics like equities and ETFs to help investors make smart decisions in the stock market. Phil does a lot of work with the Australian Shareholders Association for their podcasts as well so you might recognise his voice. He has a US focused version of Shares for Beginners called Stocks for beginners so check out the work he's done below Shares for Beginners: Spotify Stocks for Beginners: Spotify Equity ASA (Australian Shareholder Association): Spotify The ETFtracker Show - can't get by without listing ourselves here now can we? We have only been around a few months but in terms of the offering there is the weekly recap of what's happened in the news with our Exchange Traded Fridays series and then we've also spoken with people in the ETF industry via our Interview with Experts series and finally, using our tools to look under the hood of ETFs and show people how to do it with our ETF Analysis series. Exchange Traded Fridays: YouTube / Spotify Interviews with Experts: YouTube / Spotify ETF Analysis series: YouTube / Instagram

- Exchange Traded Fridays - Issue 14 - 22nd October 2021

Welcome to Issue 14 of Exchange Traded Fridays for the week ending 22nd October 2021. In this week's news we saw more news on bitcoin/blockchain/crypto ETFs as well as an update we got to give on ausbiz for the September ETF market update. Elsewhere there was more on the Livewire Markets Income series, Equity Mates spoke about FTEC and we got to speak about ESG and retail trader education with Jess Leung of BetaShares/TheLeungWay. Jam-packed newsletter as usual! What's in this newsletter? Local ETF Articles Global ETF Articles ETF Videos ETF Podcasts Tweet of the week Chart of the week ETF Education ETFtracker App Links ETFtracker Forum Listen or Watch Articles - Local AFR - Australian investors offered new crypto, blockchain ETF - We highlighted the FTEC listing from ETF Securities last week and this is the AFR note on that article that came out Thursday evening (so missed our cut slightly). Goes into some good detail on its launch as its the first passive Chi-X ETF as this smaller exchange is now set to challenge the ASX for more than just the active listings it was doing in the past (the ASX has both active and passive on its exchanges). The Conversation - What is an ETF? And why is it driving Bitcoin back to record high prices? - Even The Conversation was talking ETFs given the bitcoin news where prices have gone back above the record reached in mid-April. It does go through why the ETF listing in the US tracking bitcoin futures has had a positive effect on the cryptocurrency price but also how there are cautions when it comes to speculative assets like this especially ones as volatile as bitcoin and we'll see how true that holds in ETF form. Livewire - 2 provider-approved ETF portfolios for sustainable returns and income - Ally Selby and the Livewire Markets crew back at it again for their income series and this time she has 2 video interviews with ETF providers VanEck and State Street. Jamie Hannah and Jonathan Shead feature here giving their opinions and insights on ETFs and their distributions that investors may or may not be aware of. Check out the article and videos for more insights. Motley Fool - HGEN performance - Details on the positive performance of the ETF Securities HGEN ETF since listing on the ASX. ETF Securities - Weekly Report - w/e 15th October - Per ETF Securities: "New listing ETFS Hydrogen ETF (HGEN) was last week’s top performing ETF, gaining 8.9%. The clean energy sector posted large gains for the week with CLNE, ERTH and ACDC all amongst the top performers. Gold mining funds MNRS and GXD also performed strongly for the week. In a strong week for equities, bear equity funds SNAS, BBUS and BBOZ were amongst the leading decliners" More details in the PDF. Articles - Global AFR - Bitcoin price eyes record high as ETF products near launch - more on the price of bitcoin as ETFs start to come to market in the US not just from ProShares which has been announced but also VanEck and Cathie Woo'ds ARK Invest. CNBC SEC is set to allow Bitcoin futures ETFs to begin trading - It's finally here, after weeks, months, years of waiting, there is finally a bitcoin ETF. This tracks the futures contracts on bitcoin so won't be pegged to the price of bitcoin but it does mean direct exposure to bitcoin. With regulated assets like this it means an easier ability for institutions to get bitcoin exposure and is a positive sign for the local ETF markets. Yahoo Finance - SEC Approves Bitcoin Futures ETF, Opening Crypto to Wider Investor Base - Another one ot add to the list with quotes from folks like Nate Geraci (of the ETFStore) talking about how this is “a step forward” for digital assets and bridging them with the more traditional financial sector. Does seem like Bitcoin Futures ETFs will be all that will trade though so all those other bitcoin applications will have to wait. Funds Europe - Jacobi receives approval for "world’s first tier one" bitcoin ETF - In other news, a European investment firm, Jacobi Asset Management has been given approval to launch the first "tier one" bitcoin ETF. According to Jamie Khurshid their CEO "We are de-risking investments in crypto by removing the technology risk associated with the physical asset and the counterparty risk associated with traditional funds or tracker products that are unregulated leveraged debt instruments". More in the article. Videos The ETFtracker Show - Interviews with Experts - Episode 10 - 20th October 2021 - In this episode we got to speak with Jess Leung of BetaShares who by day is a portfolio manager and away from work is a financial social media influencer with a growing following. We go through her story and reason for getting her channel, TheLeungWay, started as well as talking about ESG ETFs and more on ETF innovation. 26mins ausbiz - The ETF tidal wave crashing down in September - 19th October 2021 - In this episode we gave the ETFtracker update on the markets for September. It featured a negative performing month of returns contributing to a big slow-down in FUM growth. There were still $2.9 billion of net inflows coming into the market but poor returns held up further growth of the overall market. We also spoke about the week tht was in bitcoin and the watershed moment that occurred with the SEC bitcoin futures listing and the ASX/Chi-X blockchain ETFs CRYP and FTEC. 7mins The Compound - 10 Stock Market Truths | What Are Your Thoughts? - In this episode its Josh, Mike and Ben all together for the first time since the last big crypto related announcement (CoinBase listing) so it's a special one. They go through the BITO (ProShares Bitcoin Futures ETF) listing and the popularity of its first trading session ($440 million volume in the first hour) and the options this gives not only institutions who want to trade this but also retail traders who might not be wanting to buy bitcoin via Binance/CoinBase and the other apps. Many just want to invest via a brokers. In the rest of hte show they go through updates on Apple, Zillow and more on risk in the market. Worth a look. 49mins ausbiz - Smart beta: how it works and why you should care - 21st October 2021 - the team chats with Yvette Murphy of State Street SPDR to go through the ins and outs of smart beta strategies and per the show notes "Smart beta strategies have seen tremendous growth over the last 10 years. While institutional investors have been investing in this style for decades, global assets in smart beta ETFs have increased from $120b in 2011 to over $1.2t today". 5mins ausbiz - ProShares US Bitcoin-Linked ETF propels BTC to record highs - 21st October 2021 - from the show notes "The ProShares Bitcoin Strategy ETF launched on the New York Stock Exchange (NYSE) this week under the ticker code BITO. Investment strategist Simeon Hyman joins ausbiz to discuss its first few days of trade. The price of Bitcoin (BTC) rallied to an all time high of $67,017" 5mins ausbiz - Sceptics feast on humble pie as Bitcoin future ETF launches - 20th October 2021 - from the show notes "The markets have embraced the first Bitcoin ETF approved by the SEC and traded on by the NYSE. Matt Harry, Portfolio Manager at DigitalX is naturally pumped by this giant leap in crypto progress, especially as not that long ago the US SEC called cryptocurrencies as the 'wild west'" 6mins ausbiz - Progress towards an Aussie BTC ETF is ... slow - 18th August 2021 - per show notes - he cryptocurrency industry got a boost Friday with the US Securities and Exchange Commission (SEC) likely to allow the first US bitcoin futures ETF to start trading, boosting BTC to over $US60k. Caroline Bowler, Chief Executive of BTC Markets welcomed this small but crucial step towards SEC oversight of the industry. She says there are no less than nine ETF applications, with this ProShares Bitcoin Strategy (futures) ETF the beginning of many seeking approval. While crypto spot and futures are volatile, Caroline is hopeful there is skill and management within the ETFs to mitigate the noise. They aso talk about the advantages of buying this as an ETF rather than directly buying bitcoin as there's the management overlay that comes with these recent moves. 7mins ausbiz - Hydrogen and uranium and how to playem - 18th October 2021 - per the show notes - The recent energy crisis in Europe and fuel shortage in the UK have brought to light the shortcomings of over-reliance on non-renewable energy, says James Whelan from VFS Group. He says this has prompted a move towards clean, renewable energy generation, with the UK government set to announce plans to fund a new nuclear power plant before the 2024 election as part of its Net Zero strategy, according to media reports. So, James says this will continue to be the theme with nuclear getting the go-ahead, followed by more emphasis on hydrogen as the transition to renewables continues in the midst of an energy crisis. 9mins Also, a couple of videos that came out on Friday 15th so missed the cut for last week's newsletter but these were important as they were significant blockchain related launches for local ETFs. ausbiz - An alternative to investing directly in crypto with the latest ETF - per the show notes "Investor demand for ETFs in the crypto space is running hot, however regulation, or the lack of it has held back products coming to market. This week that changed. While a Bitcoin ETF still seems some way off, Australian investors can now get exposure to the blockchain thematic. ETF Securities has launched first ETF targeting blockchain technology. Kanish Chugh, from ETF Securities says their product focuses on crypto innovators as well as the broader fintech theme, which we are all more familiar with because of success stories like Afterpay." 3mins ausbiz - Crypto mania hits the ETF market - 15th October 2021 - per the show notes "BetaShares is launching its very own crypto/stocks hybrid ETF. The Crypto Innovators ETF is expected to be launched soon on the ASX and will trade under the ticker code ‘CRYP’. The team is hoping to provide exposure to a portfolio of global companies at the forefront of the crypto economy. Justin Arzadon from Betashares says CRYP will offer investors exposure to this exciting space. For some names that will make it onto the ETF's balance sheet plus a conversation on why now, listen into this one." 6mins Podcasts ETF Battles - Why Water Stocks Might Offer Bigger Growth vs Technology - AQWA vs FIW vs PHO! - New ETF podcast we started listening to - per the show notes: In this episode of ETF Battles you'll watch an audience requested triple-header between the Global X Clean Water ETF (AQWA), First Trust Water ETF (FIW) and Invesco Water Resources ETF (PHO). 20mins Equity Mates - Who are the winners in the payments wars - ETF Securities - per the show notes "ETF Securities have recently released a new ETF tracking the global FinTech industry with significant exposure to blockchain technology, decentralised finance, digital payments and peer-to-peer lending - ETFS Fintech & Blockchain ETF (Exchange Code: FTEC). Alec and Bryce talk to Chris Titley, who's a stockbroker at Morgans Financial, and has a passion for this industry of emerging fintechs, digital banks and payments companies. Then they talk to Kanish Chugh, the Head of Distribution at ETF Securities Australia, about the rationale for creating an ETF that tracks this space, and the importance for retail investors to be exposed to this new disruptive technology." 39mins Tweet of the week From the desk of Eric Balchunas of Bloomberg showing the BITO ETF first day trading with around $1 billion in total volume on the first data and $440 million in the first hour - check the thread here: https://twitter.com/EricBalchunas/status/1450557742956023821 Chart of the Week BITO debut and chart from Bloomberg here: https://www.bloomberg.com/news/articles/2021-10-19/proshares-bitcoin-futures-etf-starts-trading-in-watershed-moment Further ETF Education ASX ETF Course - Introduction to buying to types of ETFs from the biggest exchange in Australia, the ASX. Check it out. Access the ETFtracker App Access to the newest version of the ETFtracker app is here: https://www.etftracker.com.au/the-app ETFtracker Forum If you're not already a member of the ETFtracker Forum then please sign up - you can access conversations and share ideas amongst peers for free. Sign up is free: https://www.etftracker.com.au/forum ETFtracker Podcast and Videos Before we go further, if you'd prefer to consume all this content in more convenient forms of media, we've launched The ETFtracker Show as a podcast and video and Exchange Traded Fridays comes at the end of each week. Additionally, we've launched a series of interviews with various ETF market participants. YouTube: https://www.youtube.com/channel/UCT6D4YStNQP-9eeXetCStKQ Spotify: https://open.spotify.com/show/2FU76nbk1QAgPxzMkLBPa0 You can also access the podcast directly on our website here: https://www.etftracker.com.au/podcasts ausbiz If you're interested in financial news you should check out ausbiz (sign up HERE) which has so much FREE financial and business content that comes out every day and has made it easier to follow your favourite topics and market experts. We get to feature on there and you can check out our page (and give us a follow) here: https://www.ausbiz.com.au/expert/mark-monfort?expertID=179

- Exchange Traded Fridays - Issue 13 - 15th October 2021

Welcome to Issue 13 of Exchange Traded Fridays for the week ending 15th October 2021. In this week's news we highlight a feature we got to do with our friends at Livewire Markets on ETFs with income focus. We also interviewed Jeff Yew, CEO and Founder of Monochrome Asset Management who are an investment firm looking to be one of the first in Australia to list a bitcoin ETF which coincides with 2 new blockchain plays being announced from 2 ETF Issuers this week in Australia and we also saw some insights out of some ESG research from Perennial Partners. Jam-packed weak so check it out below. What's in this newsletter? Local ETF Articles Global ETF Articles ETF Videos ETF Podcasts Tweet of the week Chart of the week ETF Education ETFtracker App Links ETFtracker Forum Listen or Watch Articles - Local Livewire Markets - 5 killer ETFs for your income portfolio - This is an interview we at ETFtracker got to do with Ally Selby from Livewire Markets as part of their larger Income Series. The full series is available here https://incomeseries.livewiremarkets.com/ and in it, they'll have interviews and discussions with other experts in this field. For our interview we went through the data in terms of details about the ETFs that offer income exposure and then they even asked for ideas of a balanced portfolio that could provide income and positive returns as well which we chose. Check out the article for more details and the videos section below for our interview. AUSIEX - Dive into technology ETFs - In this article, the team at AUSIEX talk technology ETFs including ACDC, ATEC, FANG, SEMI and more on the growth of thematic ETFs. Matt Tilley from AUSIEX chats with Kanish Chugh of ETF Securities about their latest listings. Stockhead - Aussie Bitcoin ETF? Close enough… ASX to host BetaShares crypto-stock-focused fund - Details of the new BetaShares crypto ETF which will track the Bitwise Crypto Industry Innovators Index (BITQ) index so Coinbase, Microstrategy and other companies in the space will be part of this index and it gives some indirect bitcoin exposure. Looks like we are getting closer to a bitcoin tracking ETF. LinkedIn - FTEC Launch by ETF Securities - Another launch this week is that of FTEC from ETF Securities which will track Indxx Developed Markets Fintech & DeFi Index and is a fintech and blockchain play. Another way to access blockchain but with a mix of financial technology. What a week of launches from Australia! Check out the link for more details which are from David Tuckwell at ETF Securities and his post. https://www.linkedin.com/feed/update/urn:li:activity:6854180067527024641/?updateEntityUrn=urn%3Ali%3Afs_feedUpdate%3A%28V2%2Curn%3Ali%3Aactivity%3A6854180067527024641%29 AFR - Millenials want their super invested in ETFs - a survey of 4,000 members by online trading platform Superhero has shown that ETFs were the most popular destination for investor money. 66% want this as the vehicle for retirement savings beating other assets like shares, crypto, property and US shares. This is higher for younger age groups as well. What is also interesting is that younger investors are wanting more crypto exposure. Livewire Markets - An ETF poised to ride a $15 trillion global opportunity - Article and interview adding more flavour to the new ETF Securities hydrogen ETF that came aboard last week (ASX:HGEN). It leads to an article from last week showing more details about HGEN so worth a look for those interested in this new ESG play. Why is the Betashares Nasdaq 100 (ASX:NDQ) ETF share price struggling lately? - From US treasury yields to market rate hikes and supply chain woes, some reasons here for why NDQ price has been off lately. ETF Securities - Weekly Report - w/e 8th October - Per ETF Securities: "Markets swayed last week on the US debt ceiling talks, inflation fears and hawkish central bank comments. Oil continued its gain and precious metals Palladium and Platinum bounced. The best performers for the week were ETFS Physical Palladium (ETPMPD) was up 6.1%, BetaShares Global Gold Miners ETF (Hedged) (MNRS) was up 5.2% and ETFS Physical Platinum (ETPMPT) was up 5%. The worst performers were broad based Asian Equity ETFs iShares MSCI South Korea Capped ETF (IKO) was down 3.9% and iShares MSCI Japan ETF (IJP) down 3.7%." More details in the PDF. Articles - Global Seeking Alpha - Father Knows Best: SEC Chair Gensler Maps Crypto Regulatory Plan, Further Entrenching Bitcoin - More on the positive news seeing increased likelihood of a bitcoin ETF is this piece from Seeking Alpha. It sees a regulatory framework being drawn out and roles for congress, SEC, CFTC and banking regulators. More in the article. Videos ETFtracker Interview with Experts - Episode 9 - The Bitcoin Expert - In this week's experts series we spoke about bitcoin ETFs with Jeff Yew and you can see that video in the link here and it was a great talk all about how Jeff got started in bitcoin and all the way to what Monochrome Asset Management are doing for clients in making it easier to understand bitcoin for when it becomes more mainstream in institutional settings (see the ETF Education section below). 32mins Livewire Income Series - 5 killer ETFs for your income portfolio - video to go along with the Livewire article we mentioned in the local ETF articles section above. 17mins ausbiz - The top four priorities for ASX-listed companies - 11th October 2021 - In this episode, Emilie O'Neill from eInvest/Perennial Partners goes through their latest 2021 Perennial Better Future Survey including greenhouse gas emissions, including alignment with the Paris Agreement and more. 4min ausbiz - Crypto's newest fan? George Soros - 11th October 2021 - per the show notes "Caroline Bowler, CEO of BTC Markets reflects on the implications of the Soros fund announcing that it was now holding bitcoin. Is this the beginning of such funds making the leap? The Soros fund certainly thinks so." 5mins ausbiz/Equity Mates - stock and an ETF for a Thursday afternoon | Equity Mates - 7th October 2021 - One we missed from last week but covers an important ETF we've been looking at, ESPO. Check it out from the crew at Equity Mates. 15mins The Compound - The Dopest Charts on Earth | The Compound & Friends #18 In this episode, Josh and Mike bring on JC Parets and Tyrone Ross to discuss cryptocurrencies, entrepreneurship, charts and more. Whilst not all ETF focused specifically, it's worth a watch/listen especially as they discuss how advisers and institutions could have an effect on cryptocurrency prices which will happen if bitcoin ETFs become a thing. At around the 19:20 mark they show the number of banks investing in crytpo and blockchain companies which could interest some readers here. JC runs All Star Charts covering technical trading and Tyrone's company is Onramp Invest which is a way for advisers to better manage crypto assets. 44mins Podcasts ETF Edge - The ESG Equation & Bitcoin Futures ETF - Description per podcast "CNBC's Bob Pisani spoke with Jan van Eck, CEO of VanEck and Todd Rosenbluth, Senior Director of ETF and Mutual Fund Research at CFRA. They discussed pending Bitcoin ETF proposals, fixed income ETFs as rates creep steadily higher and ESG-related products in the market. In the 'Markets 102' portion of the podcast, Bob continues the conversation with Jan van Eck on the commodity explosion." 29mins Tweet of the week From Nir Kaissar at Bloomberg Opinion - the battle between ETFs and mutual funds appears over... https://twitter.com/nirkaissar/status/1447526879775313921 Chart of the Week In this week's chart we take a look at the FUM of a relatively new ETF on the market, ESPO. With September figures from the ASX out we can see some net outflows but overall the ETF has been popular. You can see this portion of the chart in the ETFtracker app under the Size menu and filtered on ESPO. You can also see more info on ESPO in our recent review as part of the ETF Analysis series (some of these are filmed on weekends so we're a bit more casual than usual - hope you don't mind). Further ETF Education Monochrome Asset Management - Research and Insights - this is a new one from the team at Monochrome and timely given our podcast with their CEO this week. They also launched a new Research and Insights page (below). Whilst they have plans to bring a bitcoin ETF to Australia they also provide research into crypto so it's worth a look whether you're looking to invest here or overseas. Better yet, if you're an adviser needing to earn CPD hours - this offers you the ability to do that so check it out. Access the ETFtracker App Access to the newest version of the ETFtracker app is here: https://www.etftracker.com.au/the-app ETFtracker Forum If you're not already a member of the ETFtracker Forum then please sign up - you can access conversations and share ideas amongst peers for free. Sign up is free: https://www.etftracker.com.au/forum ETFtracker Podcast and Videos Before we go further, if you'd prefer to consume all this content in more convenient forms of media, we've launched The ETFtracker Show as a podcast and video and Exchange Traded Fridays comes at the end of each week. Additionally, we've launched a series of interviews with various ETF market participants. YouTube: https://www.youtube.com/channel/UCT6D4YStNQP-9eeXetCStKQ Spotify: https://open.spotify.com/show/2FU76nbk1QAgPxzMkLBPa0 You can also access the podcast directly on our website here: https://www.etftracker.com.au/podcasts

- ETFtracker on the Livewire Markets - Income Series - video and article!

Last week we were lucky enough to join the ranks of other market experts on Livewire Markets Income Series. They focus on ETFs, LICs/LITs and funds that provide investors with access to income. In our talk we got to highlight the range of access to different ETFs that have a focus on income including the Australian and Global Bond ETFs as well as Equity ETFs (Australian and Global) that also have a focus on income or dividend yield. The specific article we did is here: https://livewiremarkets.com/wires/5-killer-etfs-for-your-income-portfolio The series is available here: https://incomeseries.livewiremarkets.com/. Other videos/articles on this include: Ethical investing hits the mainstream You can't simply wait this out in cash Exchange Traded Funds step in as usual income sources prove costly Active, global approach unlocks full potential of hybrids The ultimate guide to picking ETFs for income And more! Make sure to sign up to Livewire Markets to see this kind of information and more on Aussie and global markets from well-known fund managers and analysts here in Australia.

- Exchange Traded Fridays - Issue 12 - 8th October 2021

Welcome to Issue 12 of Exchange Traded Fridays for the week ending 8th October 2021. In this week's news we saw a new ETF launch from ETF Securities playing on the hydrogen thematic as well as more information about market makers thanks to Russell Investments and Nine Mile Financial. Globally, we saw more info on bitcoin ETFs, a run through of active ETFs and exposure to China for US Equity ETFs. What's in this newsletter? Local ETF Articles Global ETF Articles ETF Videos ETF Podcasts Tweet of the week Chart of the week ETF Education ETFtracker App Links ETFtracker Forum Listen or Watch Articles - Local ETF Strategy - ETF Securities launches Australia’s first hydrogen ETF - This one talks about the launch of the new HGEN ETF from ETF Securities which tracks the Solactive Global Hydrogen ESG Index. It marks another ESG listed play for Australian ETFS and will cover 30 stocks. More info on this video from ETF Securities. Russell Investments - ETF Market Making – how and when to trade ETFs efficiently In this article we take a look into the world of the ETF market maker in a bit more detail as well as the 2 Russell Investments Equity ETFs (RDV and RARI). They go through a day in the life in this interview with Nine Mile Financial who we recently had on our Interviews with Experts podcast featuring Kevin Feerick from the firm (see it here on YouTube: https://www.youtube.com/watch?v=TgXiIISUxs8&ab_channel=ETFtracker. If you've ever wanted to learn more about what ETF market makers do, this is a great article for you. ETF Securities - Weekly Report - w/e 1st October - Per ETF Securities. "Short Nasdaq 100 fund SNAS was the week’s overall top performing fund, followed by short Australian equities fund BBOZ and short US fund BBUS. Energy companies ETF FUEL was the best performing unleveraged fund on the back of rising oil prices, followed by China fund CETF and global banks fund BNKS. Tech-heavy funds underperformed for the week, with RBTZ, SEMI, ROBO and ATEC all falling by more the 5% last week." Click the link to see the summary and access to the full report. Articles - Global Financial Times - Up to a quarter of US equity ETF revenues derived from China - from the home of the ETF Hub at the FT.com we see analysis by Bank of America showing that the correlation between EPS (earnings per share) in the S&P 500 and Chinese economic growth went from nothing a decade ago to 90% which made it a more important contributor than US GDP was for those stocks. It identifies some other stats there too such as the 303 companies globally with market cap greater than $9 trillion and who derive at least 5% revenue from China. As you see from their chart below, some sectors are more exposed than others. FT.com chart - BofA ETF Research, Bloomberg Bloomberg - Loomis Sayles Teams Up With State Street for a Rare ETF Foray - In this article, it describes the new team-up between Loomis Sayles and State Street's SPDR ETF brand to create the Opportunistic Bond ETF (OBND) which will track a multi-asset credit strategy and is an active ETF. This also coincides with Issue 10 of Exchange Traded Fridays (see here - https://www.etftracker.com.au/post/exchange-traded-fridays-issue-10-24th-september-2021) where we highlighted an Australian local listing for Loomis Sayles Global Equity fund (LGSE). CoinTelegraph - Futures-based Bitcoin ETF has '75% chance of approval' in October — Analyst - in this article the discussion is about the 75% chance of seeing a bitcoin futures based ETF approved by the US SEC in the coming weeks, despite continued delays on a bitcoin ETF. FINews - Active ETFS : A Guide for Investors - In this guide from FINews they go through the details about Active ETFs and the advantages (but also disadvantages of them). There's details about the market as a whole which shows $345 billion in Active ETFs globally as of July 2021 (up from only $110 billion in July 2018 and $72 billion in July 2016). Despite the US focus of this article, the points around active vs passive are still relevant. Videos ausbiz - Forrest to Wikramanyake: why now is the time to launch a hydrogen ETF - 6th October - In this episode, Kanish Chugh from ETF Securities discusses their new ESG opportunity with the newly launched HGEN ETF tracking the hydrogen megaplay. 6mins ausbiz - Is Bitcoin about to decouple from the rest of the crypto market? - 5th October - In this episode Stephen Cole from Trammell Investment Partners discusses the potential for a bitcoin ETF in the US. He also discusses the treatment from the SEC and how this cycle could be the beginning of that change led by ETF approval and increased corporate treasury adoption. 8mins ausbiz - China's pain is Japan and India's gain - In this episode, Cameron Gleeson from BetaShares goes through the ETFs focused on India and Japan when it comes to the issues being faced in China. 4mins The ETFtracker Show - Interviews with Experts - Episode 8 - Active ETFs and ESG with eInvest - In this episode we speak with Emilie O'Neill all about active ETFs, ESG, greenwashing and more. Check it out if you have not already. 32mins Podcasts ETF Edge (by CNBC) - How to play Commodities - Short segment from the crew as they go through ways to play the global commodity surge. 9mins The Alpha Females Invest - Stockbroking - The Benefits of a Broker - In this episode the team chat with Julian Hewitt from Bell Potter Securities all about the value that a broker can provide from portfolio management to diversification and stock selection. An important one if you are contemplating active ETFs as the concepts are similar. 34mins You're In Good Company - Deepdive into ETFs | YIGC with The Leungway - In this episode the crew chat with Jess Leung who is a portfolio manager as well as social media star with her Instagram and TikTok (@theleungway). They talk all things ETF so check it out. 32mins Tweet of the week Tweet from Mike Akins at ETF Action taking a look at other ways to get bitcoin exposure, via the blockchain related ETFs. https://twitter.com/etfAction/status/1445724418559266818 Chart of the Week In this week's chart we look at some of the factor based ETFs on the ASX and how they've been tracking so far including QUAL, WDMF, QHAL, QLTY and EMKT. They're all global focused (and 1 ex Australia Global) with the last being emerging markets. Interesting to see how these compare to other ETF groupings which you can access on Google Finance and see preset groupings here on our website: https://www.etftracker.com.au/google-finance Further ETF Education Info on market makers from Vanguard's Education Centre is the ETF Education piece for this week and it's a function that, whilst does not get seen in your day to day trading, your trades would not occur as easily if it were not for the market makers. The creation redemption process is a big part of what makes ETFs such a unique and valuable product. https://www.vanguard.com.au/adviser/en/etf-knowledge-trading/who-are-the-key-players-tab Access the ETFtracker App Access to the newest version of the ETFtracker app is here: https://www.etftracker.com.au/the-app ETFtracker Forum If you're not already a member of the ETFtracker Forum then please sign up - you can access conversations and share ideas amongst peers for free. Sign up is free: https://www.etftracker.com.au/forum ETFtracker Podcast and Videos Before we go further, if you'd prefer to consume all this content in more convenient forms of media, we've launched The ETFtracker Show as a podcast and video and Exchange Traded Fridays comes at the end of each week. Additionally, we've launched a series of interviews with various ETF market participants. YouTube: https://www.youtube.com/channel/UCT6D4YStNQP-9eeXetCStKQ Spotify: https://open.spotify.com/show/2FU76nbk1QAgPxzMkLBPa0 You can also access the podcast directly on our website here: https://www.etftracker.com.au/podcasts

- Getting Started with ETFs - Part 5

Where to trade ETFs Once you've considered all of these things you can count yourself much better informed about your ETFs. Your next step may involve adding these ETFs to a watchlist in whatever trading or research app you use or, if you're a spreadsheet kind of person, you can add it to a Google spreadsheet to look at past performance or track how it's doing going forward. You can also get ETF data out of Yahoo Finance if you have coding skills and can use Python. You may also want to decide on platform where you can buy and sell ETFs and there are a few out there who can help. These include your 4 major banks (and St George, Macquarie, Suncorp, Bank of QLD, HSBC, Bank of Melbourne) as well as other retail brokerages. The choice of platform is something that when it comes to picking the best, will depend on your particular circumstances, how often you're looking to trade, which markets you're looking to invest in and whether there are other benefits of going with any of these providers such as ease of having investment and other assets all under the one roof (e.g. CBA accounts and using CommSec to trade). Before we get started, this is the 5th part of the wider Getting Started with ETFs series. Just like we dive into the data, you can either dive back to one of the previous epsidoes or look ahead to future episodes when they are available. Part 1 - What to read, watch or listen to to get started Part 2 - What kind of ETFs are there? Part 3 - What data we look at when analysing ETFs Part 4 - Examples of ETF analysis Part 5 - Where to trade ETFs Part 6 - Our favourite podcasts and shows The following are listed not as an endorsement of any nor is this list exhaustive. Rather, this is to showcase the choice that is available apart from major banks: Adviser driven (Robo or otherwise) StockSpot SixPark Maqro Capital Investment platforms eToro Interactive Brokers Pearler Superhero Bell Direct Stake SelfWealth Open Trader (from Open Markets Group) Round-up/micro-investing Raiz CommSec Pocket Spaceship These different apps have different features and different assets they provide. Not all ETFs are available on each of the apps either. Below we have a few videos and articles that go through a review of these. Invest with Queenie - 11 Online Brokerage Platform Australia Compared | Best Stock Trading Apps Australia 2021 Elliot James - The BEST Trading App in Australia - Stop Paying Brokerage Fees! Michael Ko - BEST ASX Brokers To Invest In Australian Stocks 2021 (SelfWealth, Pearler, Superhero, Think, Open) The Healthy Investor - Every ASX Stock Broker Comparison in 10 Minutes | Australian Share Trading for Beginners

- August 2021 Market Update

In this update we go through the latest ASX data for August which saw FUM get to $123 billion (since known as $125 billion with Chi-X data). This followed $3.5 billion of inflows and saw total monthly returns average +2.2% for the period. Best was ATEC at 14.4% for the month. Check it out on ausbiz (where you can sign up for free): https://www.ausbiz.com.au/media/etf-funds-continue-to-build-driven-in-part-by-esg-investors?videoId=14597

- Exchange Traded Fridays - Issue 11 - 1st October 2021

Welcome to Issue 11 of Exchange Traded Fridays for the week ending 1st October 2021. In this week's news we saw some stuff on the gender pay gap and how ETFs are helping, investors getting in the clean energy sector and globally there was more chatter on bitcoin ETFs. We also have another update to the ETFtracker app as it continues to journey towards becoming even more useful for users. This time it was about combinations and bringing together the ETF Holdings Comparisons tool with the main ETFtracker app. We'll still run both for a bit longer but eventually you'll only need to go to one page to get the data you need to help you with your investing. Also this week, we spoke with Angel Zhong of RMIT for our Interviews with Experts. She gave us the research/academic view on ETFs and trading. What's in this newsletter? Local ETF Articles Global ETF Articles ETF Videos ETF Podcasts Tweet of the week - Gen-Z ETF Chart of the week - Lehman Brothers in stories ETF Education - Rask Australia on Fees and Spreads ETFtracker App Links ETFtracker Forum Listen or Watch Articles - Local ETFtracker App Update - Merging Holdings and ETFtracker data - We just keep coming out with updates over here. I blame lockdown for all the spare time on weekends but you get to benefit and this ones a big one as we merge (finally) the holdings app with the main ETftracker app and even add some additional features. Check it out. Rask - 2 quality ETF's I'd buy in October - In this article from Jaz at Rask she goes through QLTY and MOAT from BetaShares and VanEck respectively. As usual there's highlights of performance, what they hold and their costs. Short but sweet! Financy - Young women helping to close gender gap in ETFs - This article goes through the way in which ETFs has helped bring back some parity in the wealth game especially as the ETF asset class just sits behind Aussie equities and investment property and how millennials are leading the way. AFR - Investors bank on ETFs to access clean energy sector - Market data and stats showing the growth of clean energy ETFs like CLNE, ERTH and ACDC with a new one coming from ETF Securities (HGEN). There's some details of each in the article too so worth a read. Articles - Global Financial Times - Direct exposure to crypto might be better than ETFs, executives say - Another article looking at the potential of an ETF wrapper on top of bitcoin and how this could significantly open up the markets given how easily financial advisers could use it. The question is whether its too late as investors might already be getting exposure directly to bitcoin themselves. Jury is still out. Yahoo Finance - 10 Most Heavily Traded ETFs of Third Quarter - showcasing the most traded US ETFs with some familiar names we see in Australia and many new ones. Useful info if you trade global ETFs. Videos ETF Snapshots - This set of videos is part of a new ETFtracker Analysis Series where we use the various tools we've built to do a quick yet deep dive into the metrics driving ETFs as well as their underlying holdings (where availalbe in our app). We have reviewed quite a few including QUAL, VDHG, IVV, CLNE, QUS, QLTY, RBTZ, CNEW, ETHI and have more on the way. ausbiz - What's next for ETFs - FAANG cloud computing? - 29th September - In this episode, Chad Hitzeman from ETF Securities talks about the Nasdaq selloff and the TECH and SEMI ETFs they have over there. 5mins ausbiz - Green infrastructure and green reporting; diversifying your ESG exposure - 28th September - per the show notes, "ETFs meets ESG in this chat with Adam O'Connor from Betashares. He tells us that the new way to approach climate-conscious investments is to diversify and think more critically about what the companies/ETFs in your portfolio actually invest in." 5mins ausbiz - Aussie retail investors are flocking to trading platforms - 27th September - per the show notes "Andrew Tunny from Investment Trends shares his latest research into the rise and rise of the retail investors, using online trading platforms. Is this a new mega trend – online retail in the ETF space. So what is the profile of these investors, and Andrew offers three reasons why they prefer an online platform." 6mins ausbiz - How ETF investors can profit from the Evergrande crisis - 27th September - per the show notes "When it comes to getting exposure to China, you might be a little nervous even if you're an ETF investor. Damon Gosen from VanEck says he's observed a divergence between headlines and sentiment. Damon says some context is needed given the much bigger problem are declines on the ASX 200, S&P 500 and the MSCI World Index." 5mins ausbiz - From gold to FAANG+; a tour of the ETF universe - 24th September - per the show notes, "Kanish Chugh from ETF Securities reviews the gold market and corresponding ETFs after a very volatile week. Kanish says the uncertainty around Evergrande led to some buying in the precious metals space. Traders are making moves and doing it in large swathes. But what for the other end of the story and in particular, growth names like the FAANGs?" 4mins The ETFtracker Show - Interview with Experts - Episode 7 - The Academic - In this week's episode we chat with Angel Zhong, a lecturer at RMIT who has been in the news talking about retail investor trading. Whether its The MarketLit Conference, the ABC News or The Conversation or even the AFR, Angel's work has been of interest especially as many retail traders jump into ETFs. 25mins Podcasts The ETFtracker Show - Interview with Experts - Episode 7 - podcast version of the video we had with gues Angel Zhong above. 25mins The Australian Finance Podcast - Equity Mates | Approaching investing with curiosity - Per the show notes, Owen and Kate bring Alec and Bryce from Equity Mates onto the show for a wide ranging discussion on their investing journey, book launch and experience starting a media company (plus, a small Melbourne earthquake interruption). 47mins Tweet of the week Just when you though you'd seen it all, there's the Gen-Z ETF. Check out this post from Eric Balchunas for more details as to what's inside it. https://twitter.com/EricBalchunas/status/1443307785928724485 Chart of the Week This chart is from The Compound and Friends episode latest episode and shows the story count of how many times Lehman Brothers has been mentioned especially as the Evergrande crisis has been likened to it. It's been at a high in recent days but it's not the first time and will likely not be the last either. Interesting for context given where we are. Further ETF Education Rask Australia - ETF Fees, Taxes & 'Spreads' explained - Great video on a commonly asked about questions from investors differentiating between management fees (MERs) and brokerage fees as well as the importance of considering factors like spreads. ETFtracker Resources Access the ETFtracker Apps Access to the newest version of the ETFtracker app is here: https://www.etftracker.com.au/the-app Access to our holdings analysis tools are here: https://www.etftracker.com.au/holdings ETFtracker Forum If you're not already a member of the ETFtracker Forum then please sign up - you can access conversations and share ideas amongst peers for free. Sign up is free: https://www.etftracker.com.au/forum Podcast and Videos Before we go further, if you'd prefer to consume all this content in more convenient forms of media, we've launched The ETFtracker Show as a podcast and video and Exchange Traded Fridays comes at the end of each week. Additionally, we've launched a series of interviews with various ETF market participants. YouTube: https://www.youtube.com/channel/UCT6D4YStNQP-9eeXetCStKQ Spotify: https://open.spotify.com/show/2FU76nbk1QAgPxzMkLBPa0 You can also access the podcast directly on our website here: https://www.etftracker.com.au/podcasts Watch us on ausbiz If you missed our previous newsletters you might not have seen the latest ausbiz updates which mean you can now follow your favourite experts so if you want to ETF updates from ETFtracker (and others) then sign up here: https://www.ausbiz.com.au/?rh_ref=markd1d0 Once you've joined you can go to my page and add me to your watchlist too: https://www.ausbiz.com.au/expert/mark-monfort?expertID=179 ETFtracker Socials - YouTube, Spotify, Instagram, Twitter, TikTok We're on a few platforms (some more than others) so look up ETFtracker on your favourite platform for more.

- App Updates - 28th September 2021

Hi everyone, hope you're all keeping well! A couple of new updates this week to the app including the merging of the ETF Holdings Comparison tools into the main ETFtracker app. Access the ETFtracker app here (desktop only): https://www.etftracker.com.au/the-app Holdings Comparison Merged First off the bat is the new menu option to compare holdings in the main ETFtracker app. If you've followed along, this has always been the plan but it's taken some steps to get there and thanks to some folks who helped us along the way (Tim R, Tikaraj G). Figure 1 - New menu on bottom left for ETF Holdings Now users can compare and contrast the holdings of just over 180 ETFs all in the 1 app. Figure 2 - Example comparing Global Equity Factor based ETFs This also appears as a new feature for the ETF Snapshots page where users can drill into holdings for an individual ETF as they also analyse the other metrics for that ETF. Looking forward to adding more features over time.

- Getting Started with ETFs - Part 4

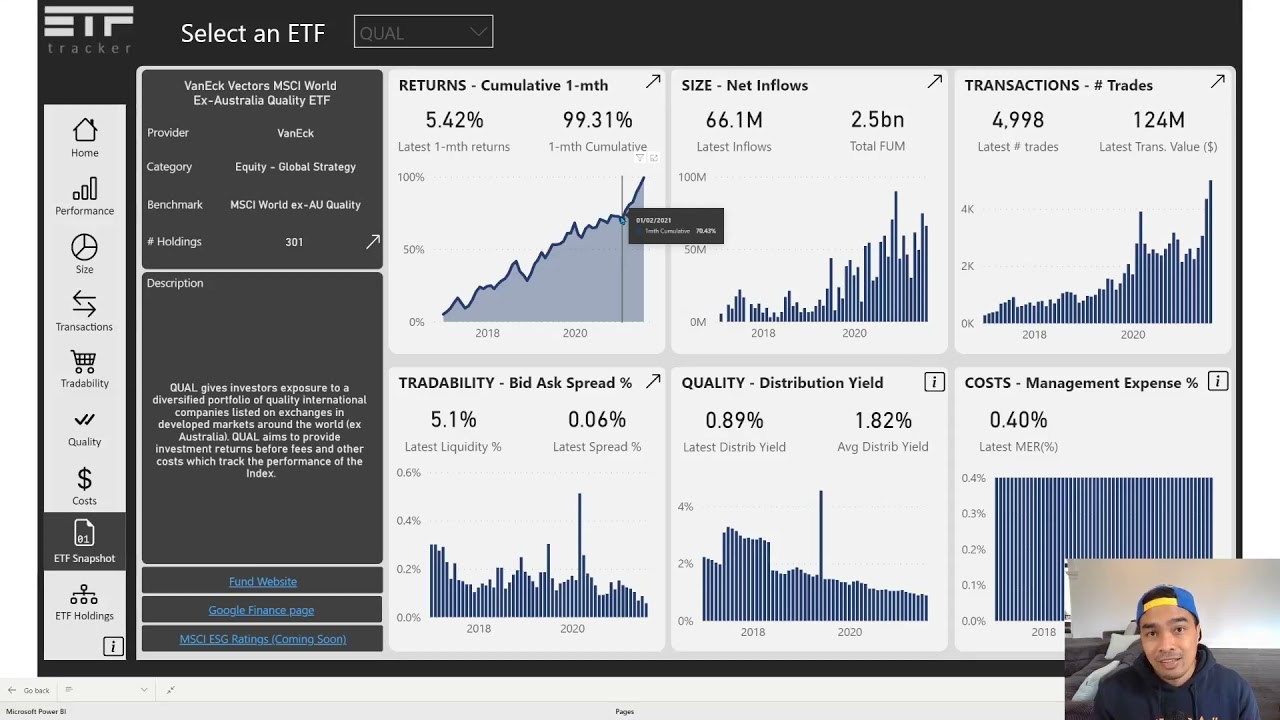

Now that you've gotten to learn about ETFs with the introduction articles, videos, podcasts (part 1), seen the different types of ETFs (part 2) and learnt about data that's important when looking at ETFs (part 3), its time to move into some analysis examples. Before we get started, this is the 4th part of the wider Getting Started with ETFs series. Just like we dive into the data, you can either dive back to one of the previous epsidoes or look ahead to future episodes when they are available. Part 1 - What to read, watch or listen to to get started Part 2 - What kind of ETFs are there? Part 3 - What data we look at when analysing ETFs Part 4 - Examples using ETFtracker to perform analysis Part 5 - Where to trade ETFs Part 6 - Our favourite podcasts and shows Examples using ETFtracker to perform analysis There are 4 options on the landing page including: Dashboard to quickly see what has happened in the latest month Analytics pages to look at overall ranks of ETFs across different metrics ETF Snapshots page to understand trends at an individual ETF level ETF Holdings comparison pages Below we showcase examples of 3 and 4 as they have been the most poular menu options used to date. We will add examples of the others over time. Example 1 - Using ETF Snapshots Using the ETF Snapshots page to see how an ETF looks based on the key metrics mentioned in part 3 is what we show here and the example is for the VanEck Quality ETF (ticker QUAL). In this example we can see various details about the ETF such a the provider, the category it sits in and the benchmark it tracks. We also have details about the holdings of this ETF which we can dive into. We can see that performane has been positive and that it has been growing in size as well as seeing more and more transactions. We look at its liquidity and spread % and finally round off with looking at yield (which has been declining slowly) and its costs. Another example of this is looking at another popular ETF, Vanguard's Diversified High Growth fund (ticker VDHG). We did this one prior to having the holdings data in the main ETFtracker app but the rest of the measures we look at are the same. Example 2 - Using the Holdings Comparison Tool to look for holdings This holdings data used to sit as separate pages (and separate apps) on ETFtracker. The following videos relate to the holdings comparison as part of the holdings analysis page but this feature is also available on the main ETFtracker app as of now. The features in this video remain the same in the main app. In this example we search for which ETFs in our coverage list contain Kogan (ASX:KGN) as we had seen it spoken about in a podcast by Equity Mates. We use the search holdings section to see which ETFs they are after looking for the ticker KGN. In this video we use the same feature but this time to look for Evergrande exposure. We see that exposure is limited for this stock in the ETFs in our coverage but it's important to remember that whilst there may not be direct impact from Evergrande there may be banks, insurance and other companies that are negatively effected by a company like Evergrande and these may be more prominent in an ETF.

- ETF Dictionary

List of terms used in the app and articles on ETFtracker as well as those seen amongst various ETF discussions online (and amongst my retail trading friends). Use this to help you decipher the jargon. We will be adding to this with more definitions over time. ETFtracker Data Terms The following terms come from the app and are based on data that comes from the ASX and Chi-X exchanges. Performance 1-month and 1-year total returns - this is the Total Price returns from Bloomberg for the month being measured and takes into account dividends being reinvested. The ASX and Chi-X provide this on a 1-year basis as well. 3-Year and 5-year total returns - these are also provided in the app but refer to the annualised total returns on a 3 and 5-year basis where those ETFs have that data available. Size FUM - Known as funds under management (and also called assets under management), this is the total amount of investments held in a particular ETF. Net Inflows - refers to the money going in and flowing out of an ETF. The ASX and Chi-X report the net figure here so if it is positve then more money came than left and vice versa if negative. This takes into account primary and secondary market transactions. Transactions Number of Trades - Refers to how many times the ETF was traded during the month. Transaction Volume - Refers to how many shares of the ETf changed hands across those trades. If transaction volume was 3 million and there were 1,000 trades then each trade had 3,000 shares of that ETF traded on average. Transaction Value - Similar to transaction volume but this is the dollar value. If the transacted volume for the month was $1 million across those 1,000 trades then the average trade was $1,000 in size. Tradability Monthly liquidity - monthly liquidity is defined as total value traded / assets under management. % Spread - this is the differnece between the price that buyers want to purchase an ETF and the price at which a seller will part with their shares. BetaShares has a good page on this topic "How do ETF bid and offer spreads work?". Also check out this video from Rask Australia which covers spreads (as well as taxes and fees): https://www.youtube.com/watch?v=22-aJwQCnPE&ab_channel=RaskAustralia Quality Distribution Yield - sum of dividends over the last 12 months from the relevant date /last price for the last business day of the relevant month. Costs Management Expense Ratio (MER % )- MER is an expression of the total costs for investing in the ETF. The user does not pay this out of pocket. Rather, the fees are deducted as part of the users investment. More details can be seen at Rask Australia with a dedicated page on this topic. Other common ETF terms Active vs Passive ETFs - these are the 2 different ways that ETFs can be managed and they have some similarities but quite a few differences too. Passive will typically track a benchmark and replicate those whilst active are built to find some sort of outperformance. That said, passive ETFs have outperformed active but there are opportunities for both in a portfolio. More on this topic from Magellan for ETFs (Active ETFs and Passive ETFs - What's the difference?) and Investopedia on active vs passive investing in general (Active vs Passive Investing). Brokers - brokers are the various providers you use to buy ETFs and other investments from. The biggest in Australia is CommSec (part of CBA and full name Commonwealth Securities). The major banks all have facilities for their customers to invest but there are also a number of independent brokers such as Pearler, Stockspot, Raiz, Six Park, Open Markets to name a few. ETF Issuers - Issuers are the firms that create or bring ETFs to market. These include companies like Vanguard, BetaShares. ETF Securities, eInvest and more. Some companies provide their ETFs under a brand name like BlackRock and its iShares brand for the ETFs it has on market. Other ETF Issuers will partner with other firms to create an ETF brand such as Fidante's ActiveX partnerships with Ardea and Kapstream or VanEck partnering with Morningstar for its economic moat series. Core-Satellite Strategy - This relates to portfolio construction and is the idea that you have a core set of assets where you are invested, typically index funds and typically tracking broad investments like the ASX 200 or S&P 500. The core is hardly touched. The satellites are more active investments and can be in thematics or sectors like robotics or technoology. Vanguard have a great guide on Core-Satellite strategies so take a look (Vanguard's Guide to Core-Satellite Investing) Portfolio Composition File (PCF) - see Holdings. The PCF is typically what is referred to when looking for the holdings file. Active ETFs can be non-transparent or semi-transparent and thus may not necessarily provide this file or showcase it in detail. Rebalancing - the process of ETFs changing their holdings typically as a result of the benchmark being tracked changing its holdings too. Typically done on a quarterly or 6-monthly basis. Sharpe Ratio - The ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk. Volatility is a measure of the price fluctuations of an asset or portfolio. Higher Sharpe Ratios are positive. More on this here: Investopedia - Sharpe Ratio Sortino Ratio - Sharpe Ratio variation with a twist as it differentiates between good and bad volatility. More details here: Investopedia - Sortino Ratio Tracking Error - per Investopedia, "Tracking error is the divergence between the price behavior of a position or a portfolio and the price behavior of a benchmark." More here: Investopedia - Tracking Error Transparency - typically refers to how much information about the underlying holdings of the ETF is available. For example, passive ETFs typically publish their holdings data on a daily basis and this is their full holdings. For active ETFs this is not always the case and may even be delayed. These are actively managed so there is a disadvantage to managers if they publish daily.

- Getting Started with ETFs - Part 3

In this 3rd part of the wider Getting Started with ETFs series we dive into the data and look at what types there are. You can dive into this series too, either back to previous articles or ahead to the next topics. The other parts in this series are below: Part 1 - What to read, watch or listen to to get started Part 2 - What kind of ETFs are there? Part 3 - What data we look at when analysing ETFs Part 4 - Examples of ETF analysis Part 5 - Where to trade ETFs Part 6 - Our favourite podcasts and shows What data we look at when analysing ETFs Now that you’ve done some homework on your investing personality and the type of ETFs you’d like to buy the next step is to look up a few on Google and choose them just by their name right?Wrong (of course). Well, you can do that and whilst there’s nothing wrong with YOLO’ing away your life savings if your bets pay off, you don’t want to be the one to have regrets and say you should have done your homework or have other tell you that. With ETFs, it's all about looking under the hood and there's some great ways you can do that. You can go to the fund websites and do some research and analysis there. You can look at other resources (such as those found in the resources menu on our website). We did this when we began investing and whilst the data is out there, it can be time consuming. That's why we created ETFtracker in the first place. It was an app to help us become efficient at analysing ETFs to help ourselves and now we get to provide this to everyone to see if it helps them. At ETFtracker we’ve used the data we collect to help people look under the hood. There’s a lot of data out there so this collection of interactive apps has made it easier for us to do analysis and hopefully it can help you too. The data that we provide at ETFtracker to enable the analysis of ETFs can be categoriesed into 2 broad groups: ETF Market Statistics ETF Holdings We take a look at these in more detail below. First up is the monthly metrics we collect from the ASX and Chi-X as well as other data we've sourced online. After that we can use our holdings tools to look at the underlying holdings of those ETFs as well as ensure that if you’ve chosen a group of ETFs for your portfolio, you don’t have too much crossover across them. ETF market statistics The ETFtracker app we have built looks at various statisics that we group into 6 areas that paint a picture of a single or group of ETFs. We have these as 6 different areas users can navigate to alongside some other options. In this area, users can explore these metrics across all ETFs, Categories and Thematics in the app. Figure 1 - Highlighting main menu popouts in ETFtracker app Also, we combine that into something to give users a quick view of how individual ETFs look against these measures via the ETF Snapshots menu option. Figure 2 - Example of ETF Snapshot page looking at HACK Below we take a look at what these 6 metric groups are all about: 1. Performance - this is all about the price and how well (or poorly) and ETF has performed. The data from the ASX/Chi-X is based on Total Price returns from Bloomberg and takes into account dividends being reinvested. This is historical price data and on a monthly basis but we do link to the ETFs performance per Google Finance (which you can see if you go to the ETF Snapshot page for that ETF). 2. Size - this looks at both FUM (funds under management) as well as Net Inflows and is a sign of how popular an ETF is. Even if an ETF has low FUM compared to others, if its been showing strong signs of increasing growth then that can still be positive. Additionally, some ETFs experience strong level of inflows early on but then stagnate. This does not mean to give up on them but definitely there is a need in that case to look at other factors for that ETF and see if slowing inflows are offset by other positive factors. 3. Transactions - this looks at the number of trades, transaction volumes and transaction values for an ETF. This indicates if investors are buying and selling this ETF. If an ETF has limited transaction activity it can be because there are limited buyers and sellers for that ETF or many investors are buying and holding it. There might be other factors that make this ETF a positive one to have but transaction trends can be helpful to understand. 4. Tradability - we look at 2 metrics here, monthly liquidity and % spread. If a stock has low liquidity it is harder to trade as there's not much volume around and if it's spread is high that means it is harder for buyers and sellers to meet at agreeable prices. The opposite (high liquidity and low spreads) are more ideal for investors but again, this area is one factor to consider amongst others. 5. Quality – quality is measured by looking at historical dividend yield / distributions of the ETF. The calculation here is based on a rolling 12-month level of distributions per the current share price so a stronger yield % here indicates the ETF has been improving the distributions it provides to investors. Some investors want to have ETFs with strong yield whereas others don’t care as much as performance or ETF infows are more important for them. 6. Cost - this is analysed by looking at the Management Expense Ratio (MER) for the funds. Some ETFs such as active ones are inherently more expensive than pure index tracking ETFs but that does not mean you should always chase the lowest cost ETFs. An example of how you can look at the stats together is that you might be seeing an ETF with increasing transactions can indicate popularity increasing for that fund or stabilising depending on the data. In addition, you might see that this ETF has increasing size but low number of trades which could mean it’s institutional money that’s trading it rather than retail investors and you’d prefer to see something being bought up by all investor types. In general it is good to see ETFs with positive or improving performance, growing size of inflows/FUM, increasing or steady level of transactions, lowering spread % or and strong liquidity and depending on the type of ETF you’re after, reasonable distributions and costs. ETF holdings The next part we provide is looking under the hood of the ETFs even further by analysing their holdings. Having access to holdings can help users choose which ETFs they think will co-exist better in their portfolio. Additionally, looking at ETF holdings is important because a user might not realise they have 2 ETFs that, for example, have very similar holdings and thus are potentially paying twice for the same kind of performance. Having access to holdings data allows users to check how similar their holdings are across the ETFs they own and can also be used to search for ETFs that give exposure to a particular company or theme. ETFtracker has pulled together for over 170 of these ETFs with the majority being equity related ETFs. There are some caveats to the holdings data which are detailed in the ETF Holdings Comparison Guide. Right now, the holdings analysis tools sit in separate apps and on a separate page to the main ETFtracker app but eventually they will be merged into a single app. Caveats There are other areas to consider when looking at ETFs that ETFtracker does not provide. The ASX, Chi-X and issuer data we collect has some great insights but there are more out there. This includes: Tracking error (for passive ETFs) - this refers to how well does this ETF track its benchmark and is usually available on the funds website. Volatility - the up and down price movements of an ETF might have an effect if you're a short term holder but given most ETF investors have a longer term view, short-term volatility might not be a concern. Still, it's not true that investing in ETFs are so safe that you can't lose money. Any money at risk is precisely that, at risk and whilst diversification can mitigate losses and diversification is higher in ETFs, it does not mean that ETFs come without some volatility. Additionally, ETFtracker is still undergoing further improvements such as providing the ability to easily benchmark ETFs against each other to enable easier comparisons between ETFs within their own sectors or other comparison groups. Other considerations include the invesment philosophy of the ETF's portfolio managers, what benchmark they track and more about the company issuing them. You can see this information on the ETF Snapshot page as we provide a link back to each funds page (see below) Resources As much as we can quickly crunch the numbers on this sort of data, there are some things we don't have as datapoints that we collect. For example, our pricing is only reported monthly so you can look at this info for a long-term perspective but you should look to something like Google Finance for more up to date pricing and news. Here's a couple of links to resources we mentioned above and more. ASX Monthly Reports: https://www2.asx.com.au/issuers/investment-products/asx-funds-statistics Chi-X Monthly Reports: https://www.chi-x.com.au/funds/monthly-reports Google Finance (example here from ETFtracker site): https://www.etftracker.com.au/google-finance Yahoo Finance: https://au.finance.yahoo.com/quote/VDHG.AX?p=VDHG.AX Next up it's Examples of ETF analysis.